All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Consists of information on costs, qualification, renewability, restrictions and exemptions. Not eligible for non-AARP participants in AK, LA, and OR. The licensed life insurance representative is D. N. Ogle (Arkansas # 17009138, California # 0L37586). The AARP Life Insurance Policy Program is underwritten by New york city Life Insurance Policy Company, New York City, NY 10010 (NAIC # 66915).

Specific items, functions and/or presents not readily available in all states or nations. New York City Life Insurance Policy Company is certified in all 50 states. There are various other products readily available under the Program that have various costs, benefit amounts, protection lengths, underwriting, and various other functions like persistent health problem acceleration. Click right here or require details.

Some Ideas on Aarp Guaranteed Life Insurance From New York Life You Need To Know

AARP has developed the AARP Life Insurance Trust fund to hold group life insurance plans for the benefit of AARP members. Full terms and problems are established forth in the team policy issued by New York Life to the Trustee of the AARP Life Insurance Policy Depend On.

Are you searching for assured acceptance life insurance without a waiting period? Look no more! Our agency can provide to to virtually any person that is working at least 20 hours a week. If you have actually been declined for insurance policy before, this could be your only option for life insurance coverage protection without a waiting period.

The plan likewise offers optional riders for partners and kids. You can guarantee your partner for as much as $30,000 and your children, aged 26 or more youthful, for approximately $20,000. While no extra demands are needed to get this protection, it does boost the cost compared to a single-person plan.

More About How To Get Instant Life Insurance Online

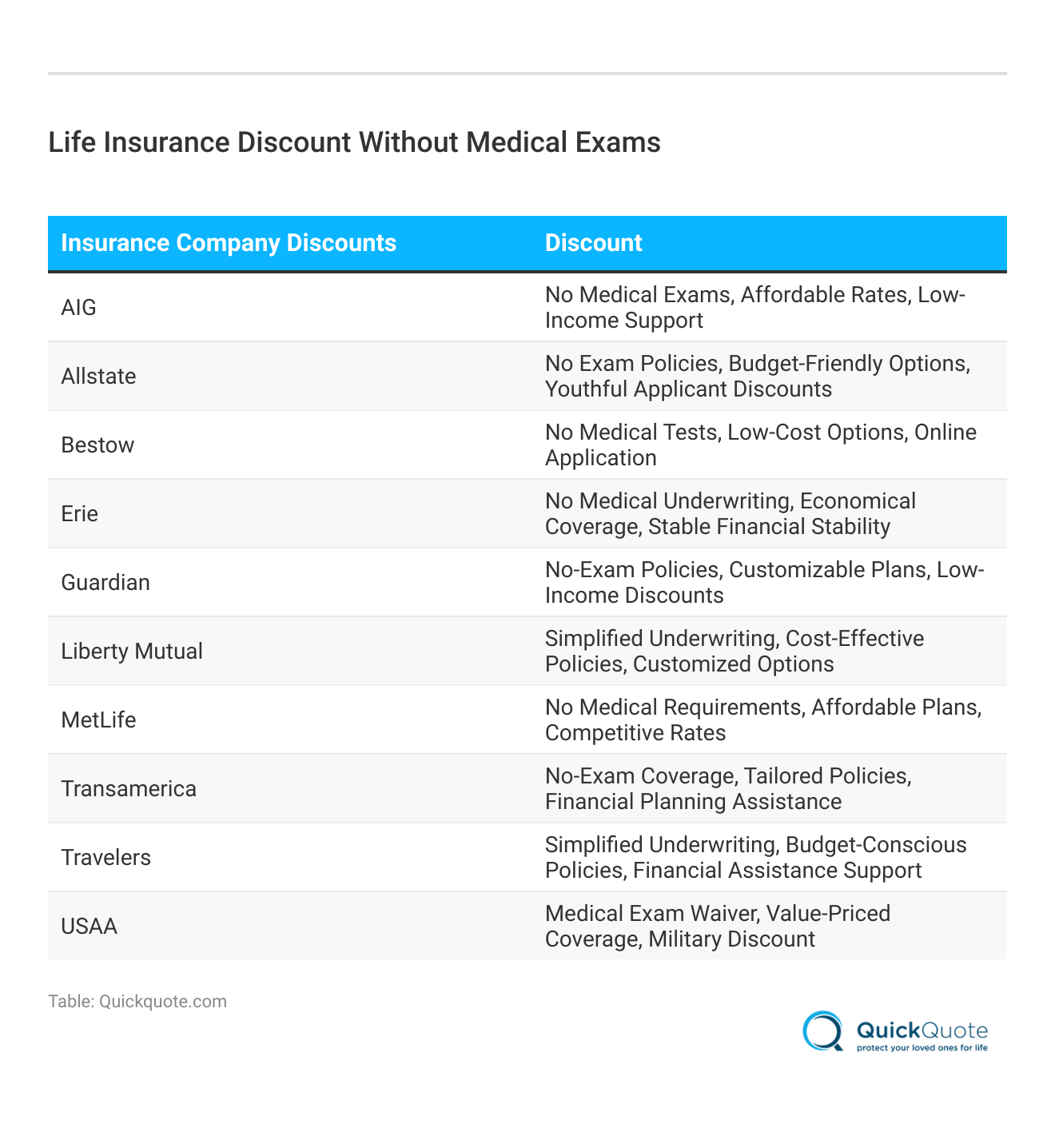

Give us a phone call today and we'll help you obtain started. In the table listed below we've given some sample prices by age and sex for $50,000 of ensured concern life insurance policy without a waiting period. If you buy one on these policies, your family or liked ones will certainly be shielded as soon as you make your first payment.

If these rates don't fit your budget, we'll assist you find the excellent plan for your requirements. We can supply as little as $10,000 or as much as $75,000 of prompt guaranteed life insurance policy protection without any kind of health and wellness details. To acquire an exact quote, click in the form listed below, or call us toll-free at.

No medical examination is required for an authorization and the insurance provider will not evaluate your clinical records. You are ensured to be accepted. The trade-off with assured life insurance policy plans is that they do not supply complete protection for two-years. This implies that if you die from any kind of health-related problem throughout this moment, your family members will not obtain the complete survivor benefit from your life insurance coverage plan.

No waiting duration needed. Your policy begins as quickly as you make your initial settlement. Toll-Free: The majority of life insurance carriers will not offer ensured approval life insurance policy to applicants that under the age of 40. Our company can offer as long as $75,000 of protection to virtually anyone over the age of 18 if they are currently operating at least 20 hours a week.

What Does Fast Life Insurance: Best Companies For Quick, No-exam ... Mean?

Provide us a telephone call today, toll-free:. Created by: Cliff is a certified life insurance policy agent and among the proprietors of JRC Insurance Group. He has assisted thousands of family members of organizations with their life insurance policy requires given that 2012 and specializes with candidates that are less than excellent health. In his leisure he delights in spending time with family, traveling, and the outdoors.

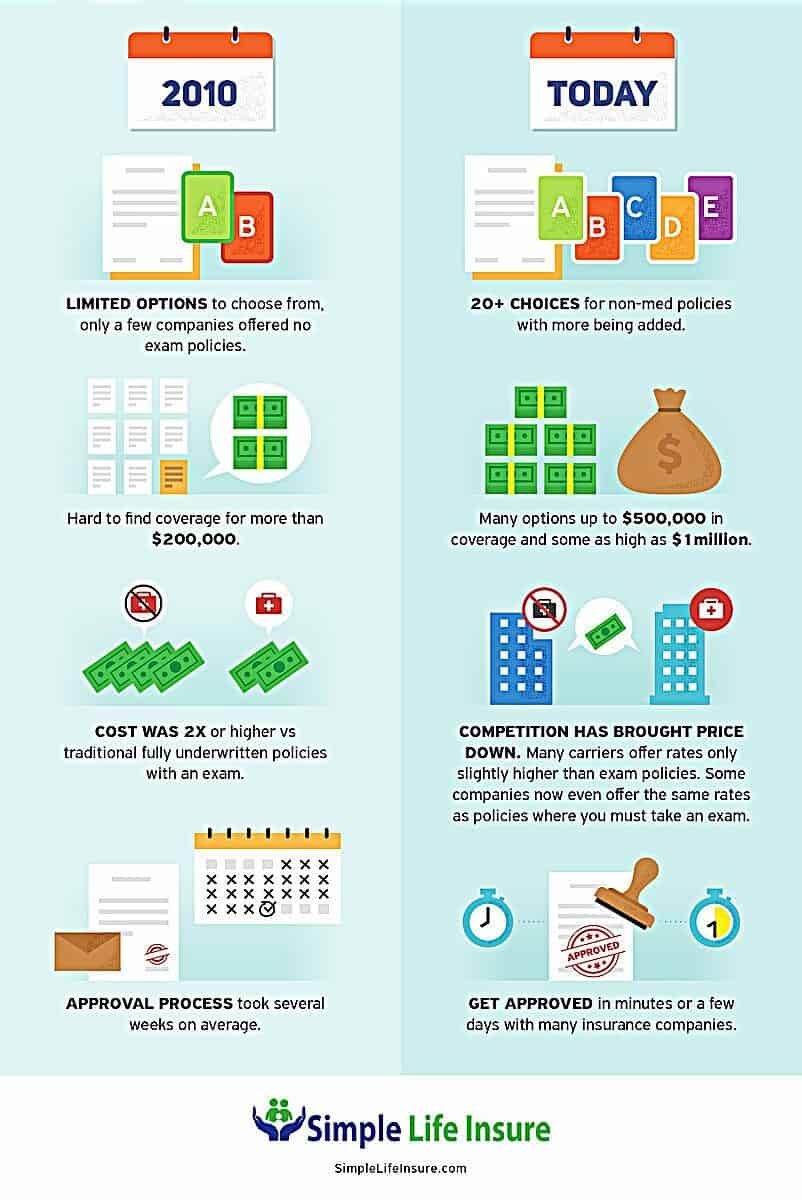

In this write-up, we'll answer one of the most often asked inquiries about life insurance policy, no medical exam.: No medical examination life insurance policy consists of term and whole life choices, with term being more inexpensive and entire life offering long-lasting coverage.: Insurance firms take care of danger in no exam plans by billing higher costs or using alternate health information resources.

It is necessary to note, nonetheless, that the survivor benefit is just payable if the insurance holder dies within the term. Term life insurance coverage is also appealing for seniors concentrating on long-lasting planning. Opting for term life insurance policy without a medical examination can be useful, specifically if you have a clear idea of your insurance coverage period.

7 Simple Techniques For Life Insurance - Get A Free Quote Online

Choosing whole life insurance policy without a medical exam simplifies the process and offers enduring assistance. Recognizing the Infinite Financial Principle and How It Functions In Our Modern Environment 31-page eBook from McFie Insurance Order here > Insurance provider are really efficient managing danger. They examine health and wellness and way of living details on each candidate and utilize this information to identify what amount of premium will be required in order for the plan to be released.

Latest Posts

The Best Strategy To Use For Life Insurance

More About No Medical Exam Life Insurance: Can I Get It?

More About Dave Ramsey-recommended Affordable Life Insurance